JBA Global Master SP

The fund JBA Global Master SP is a Long-short equity Technology, Media, and Telecom (TMT) Fund. The Fund is managed by a research team consisting of global macro and sub-sector specialist.

INVESTMENT PHILOSOPHY

The Fund’s mission is to provide investors with sustainable capital appreciation over a long period by long sub-sectors & companies with attractive growth potential or turnaround, and to short those losing competitive edges i.e. market share, pricing, & profitability.

JBA in Numbers

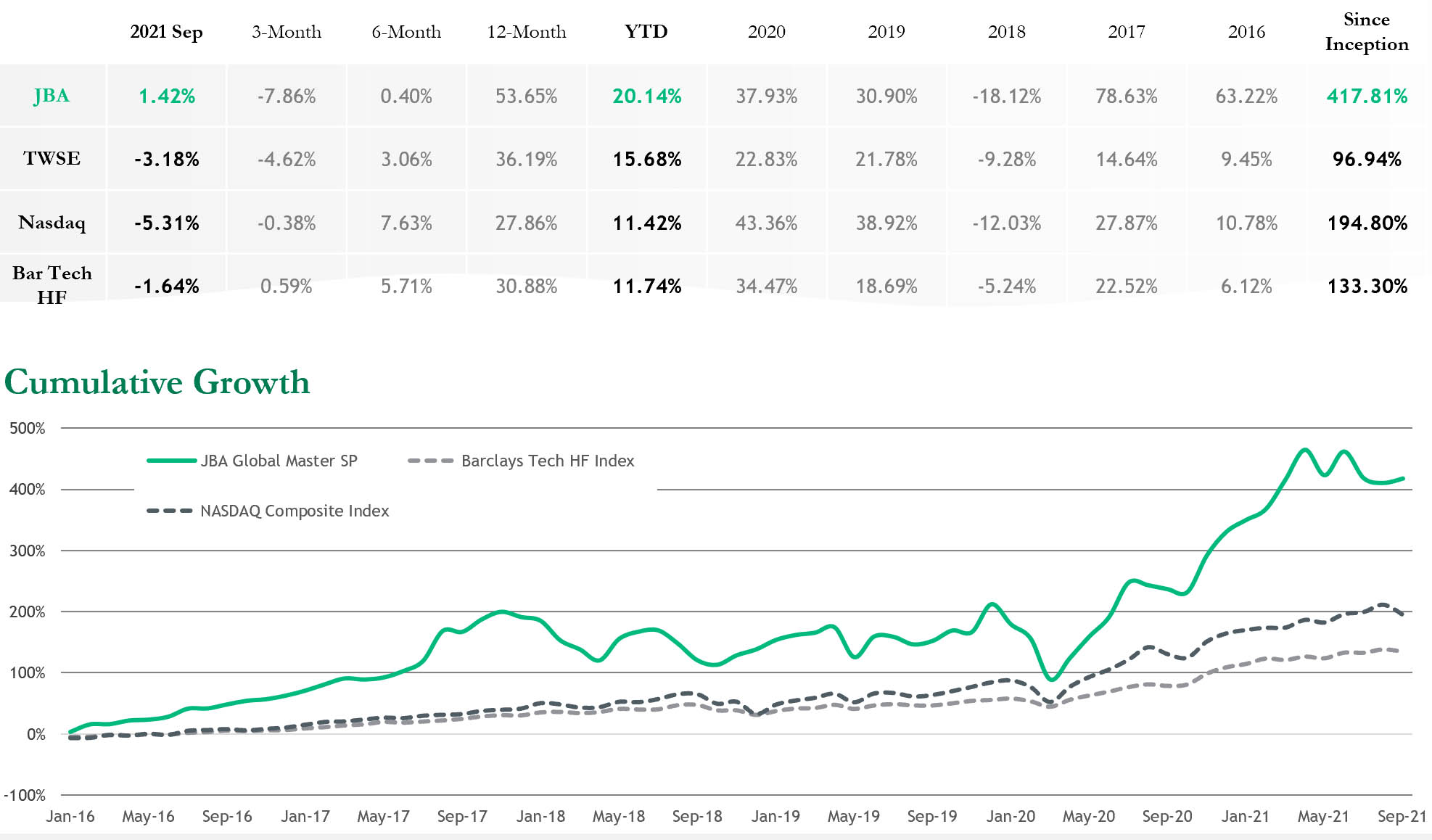

*Track record is from source period 2016/01/01 to 2021/09/30

Our Investment Approach

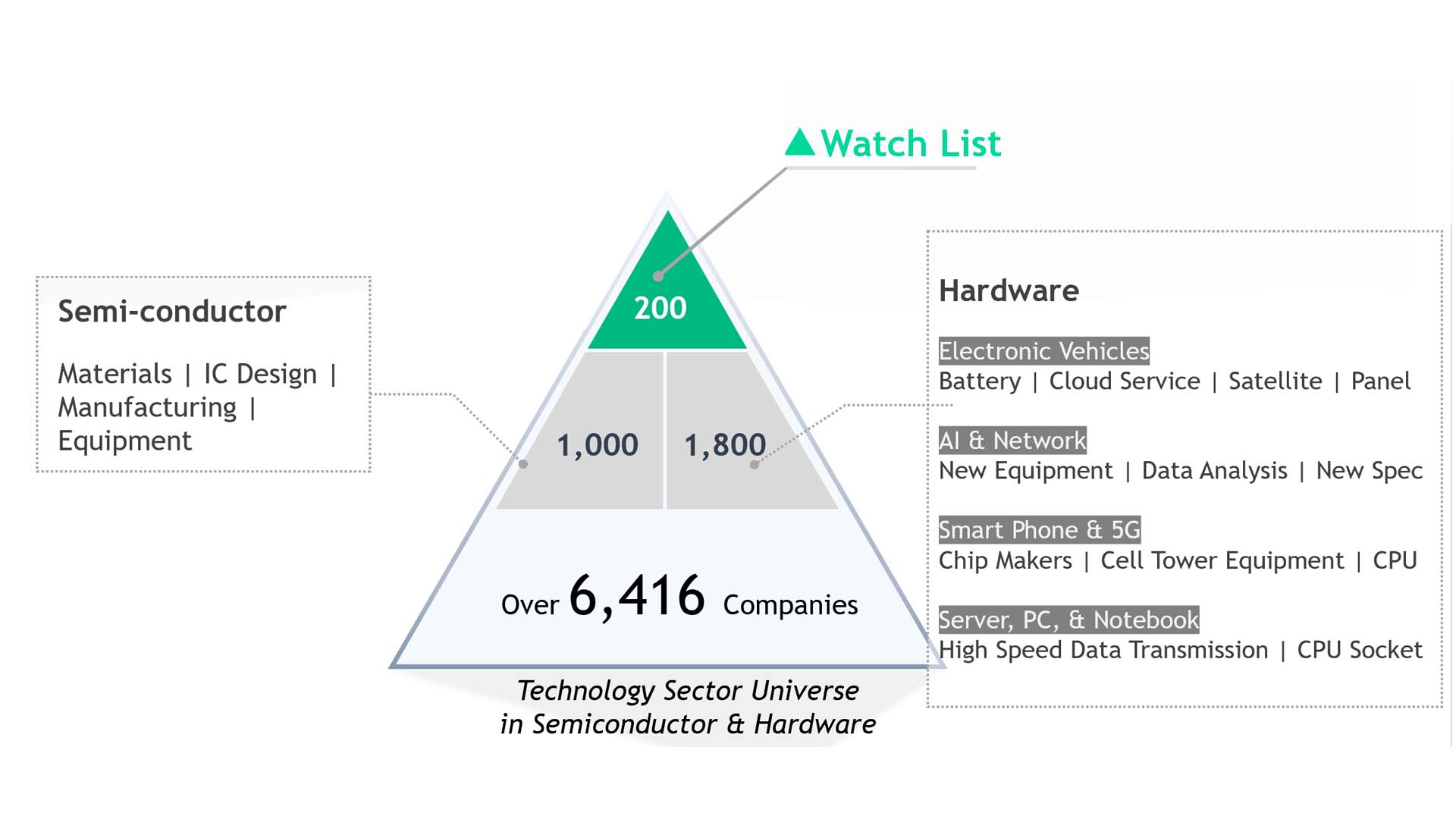

We understand the global opportunities of the TMT technology sub-sectors in supply chains, product cycles, market share shifts, & pricing trends, and invest in promising sub-sector targets:

JBA Foresight

We take pride in our team of TMT industry veterans; we recognize latest industry trends 6 – 12 months ahead and position our capital before the broader market even takes notice.

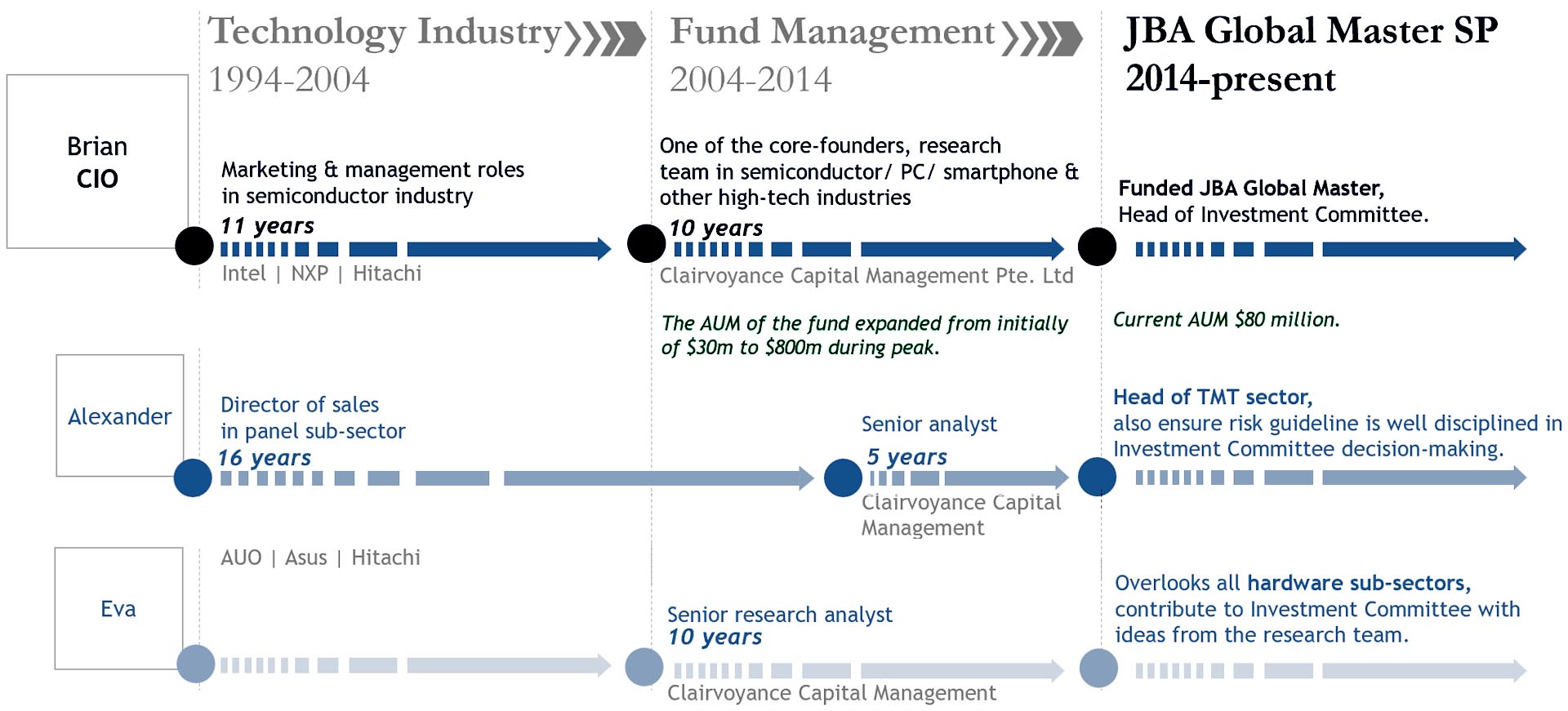

Human Capital

Our zero turn-over rate since the launch of the Fund is a result of our sustainable training system, and our growth track record. We align incentives with overall fund performance and well-managed operations & risk, and retains the best talents in a self-driven, results-oriented culture.

Rigorous Research Process

Collaborative and critical thinking, rigorous debates and constant feedback amongst the investment committee enable us to bring forward the best investment ideas.

Integrity & Transparency

We value integrity, and open communications amongst team members, investors and business partners. Integrity & transparency are the foundation of our long-term success.

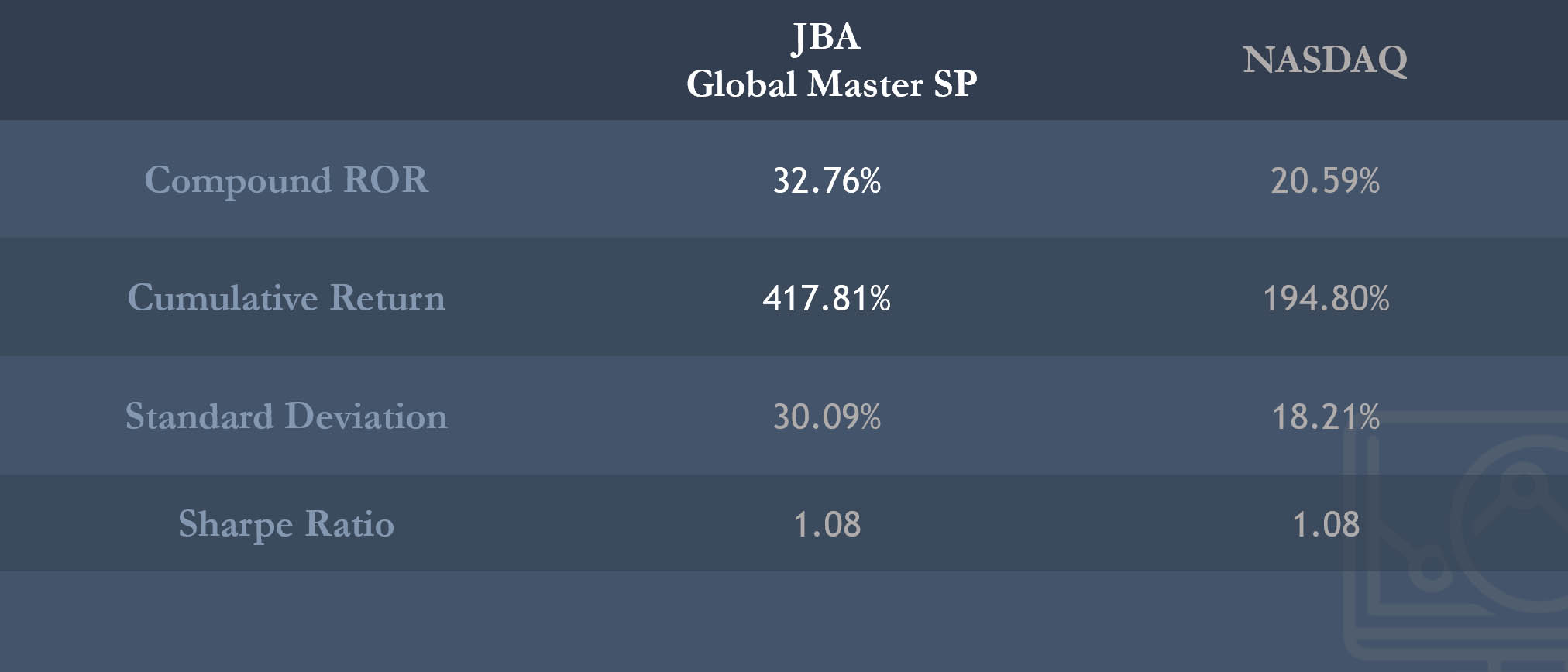

Fund Performance

Fund Performance Analysis

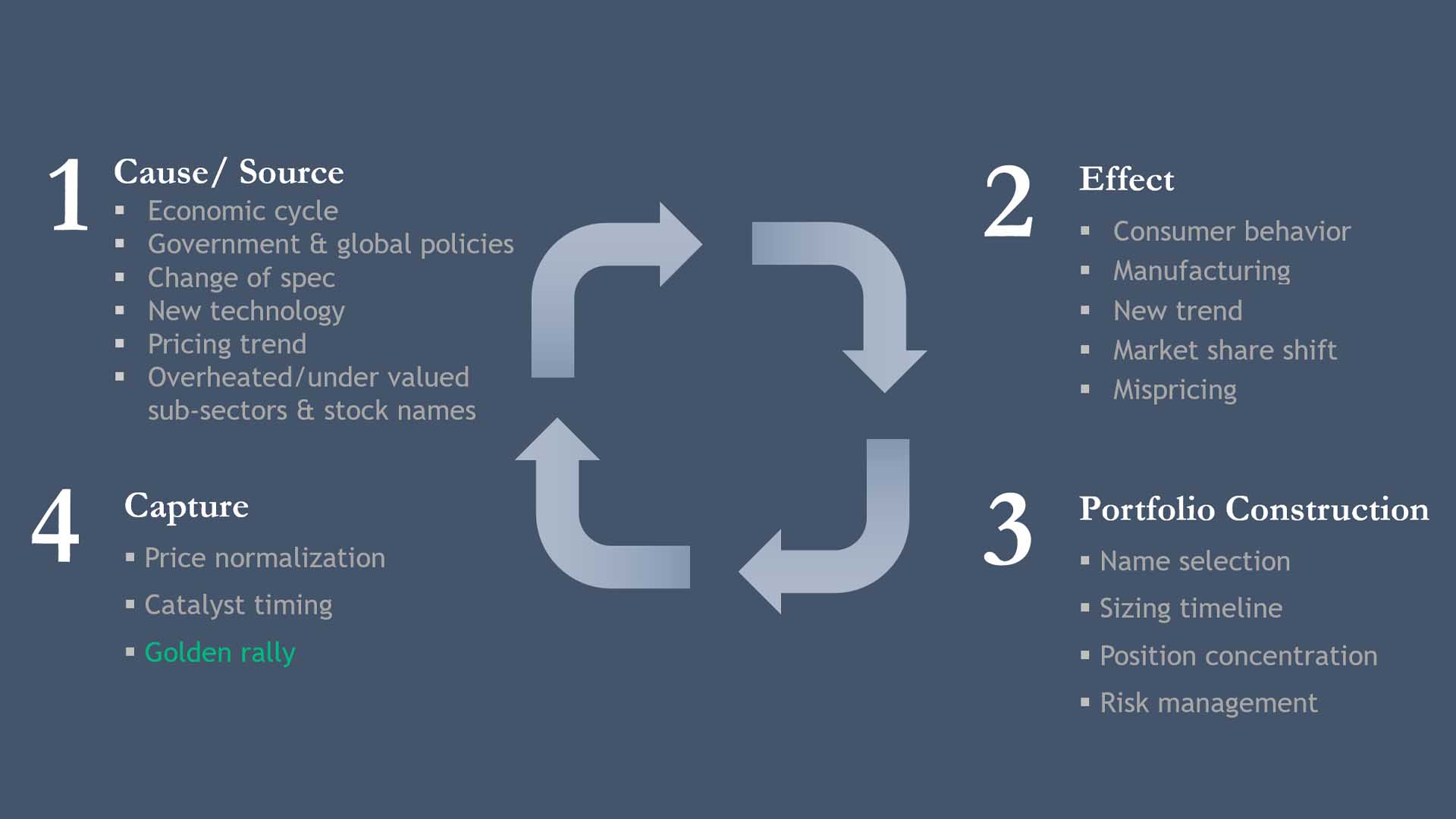

Top Down

What are the next trends in tech?

With our 30+ years of combined experience in the TMT sector, we have deep knowledge in the tech industry where we can identify the latest trends and key themes in tech from next generations products and upcoming industry leaders.

Bottom Up

How do we find targets among it all?

Our proprietary research models have stood the test of time and help connect the dots through channel checks, conversations with industry experts, and specialized research materials. From this we are able identify market catalysts and discrepancies with consensus.

Stock level

Concentration & catalysts timing

are keys to performance.

Portfolio level

Diversification Discipline

Diversification is at the core of our risk management philosophy. We strive for the right balance between:

Investment Strategy

Long-short Equity Arbitrage

The fund capitalizes on both long/short opportunities in supply chains, product cycles, market share changes and pricing trends primarily in the TMT sector.

1. “Think Business” Investment Approach

Strong product knowledge and business acumen to identify trends before others do.

2. Flexible Mandate

Ability to leveraging in the secondary market to optimize results within investors’ expectations.

3. Global Technology

Geographic advantage in Asia provides insight to identify global tech lucrative opportunities.

4. Horizon

Investment horizon is usually 12-36 months to catch golden rally.

5. Multi-Faceted Risk Management

Rigorous risk discipline allows us to mitigate market volatility on a portfolio level.

Highly Liquid Investment Universe

Opportunity Cycle

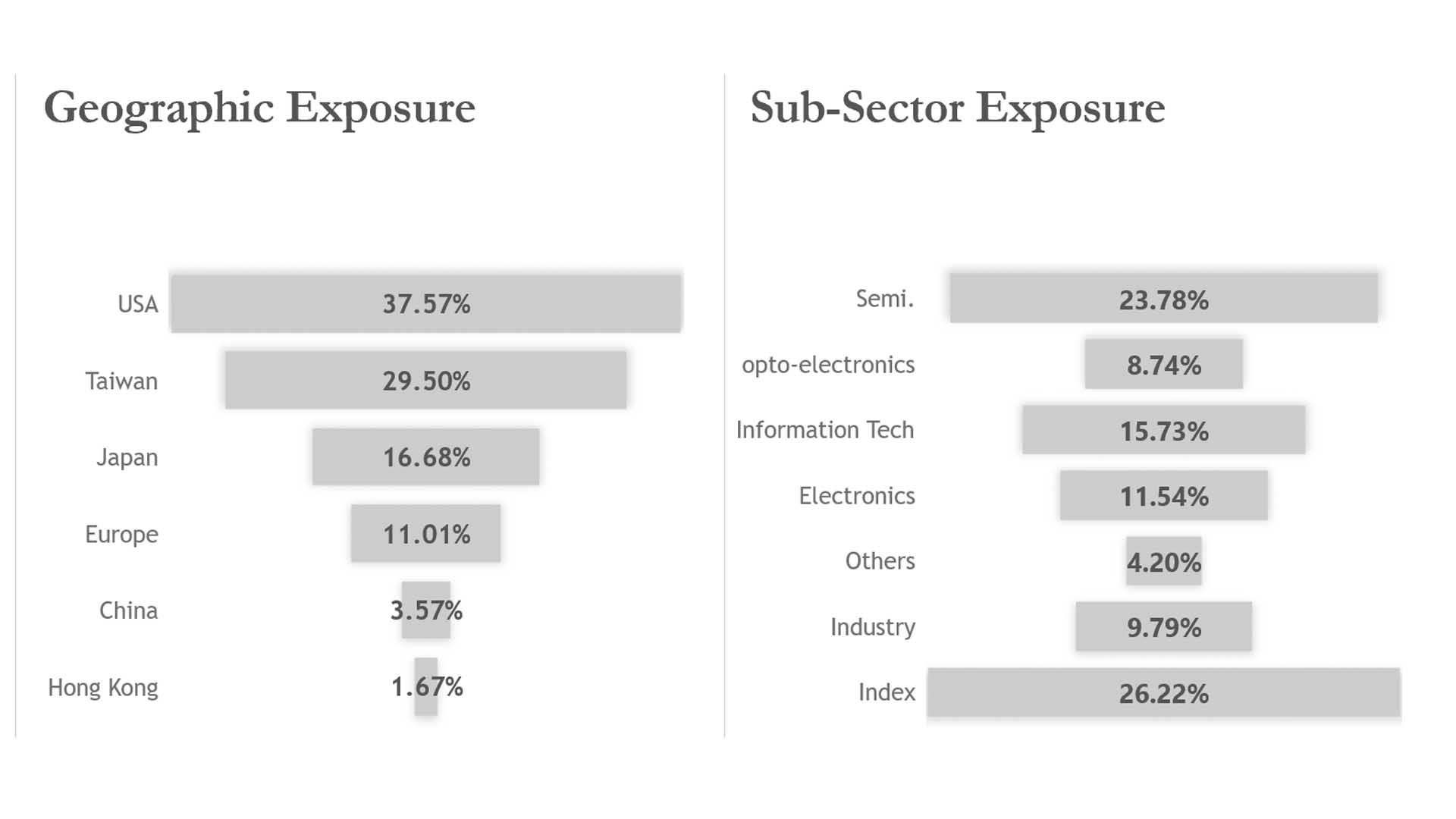

Country Sector & Exposure 2019-2021

Risk Management

Cut loss

Down 5% → Review the position

Down 15% → Sell 50% of the position

Down 20% → Sell 100% of the position.

*Decisions are discretionary to Investment Committee.